Comparing Debt Consolidation Loans for Americans

An in-depth comparison of debt consolidation loan options available to Americans to simplify payments and reduce interest.

Comparing Debt Consolidation Loans for Americans

An in-depth comparison of debt consolidation loan options available to Americans to simplify payments and reduce interest.Hey there! Are you feeling swamped by multiple debts, juggling different due dates, and watching your hard-earned money disappear into high-interest payments? You're not alone. Millions of Americans face this challenge every day. The good news is, there's a powerful tool that can help you get your finances back on track: debt consolidation loans. Think of it like this: instead of fighting a hydra with many heads (your various debts), you're cutting off all those heads and dealing with just one, more manageable monster.

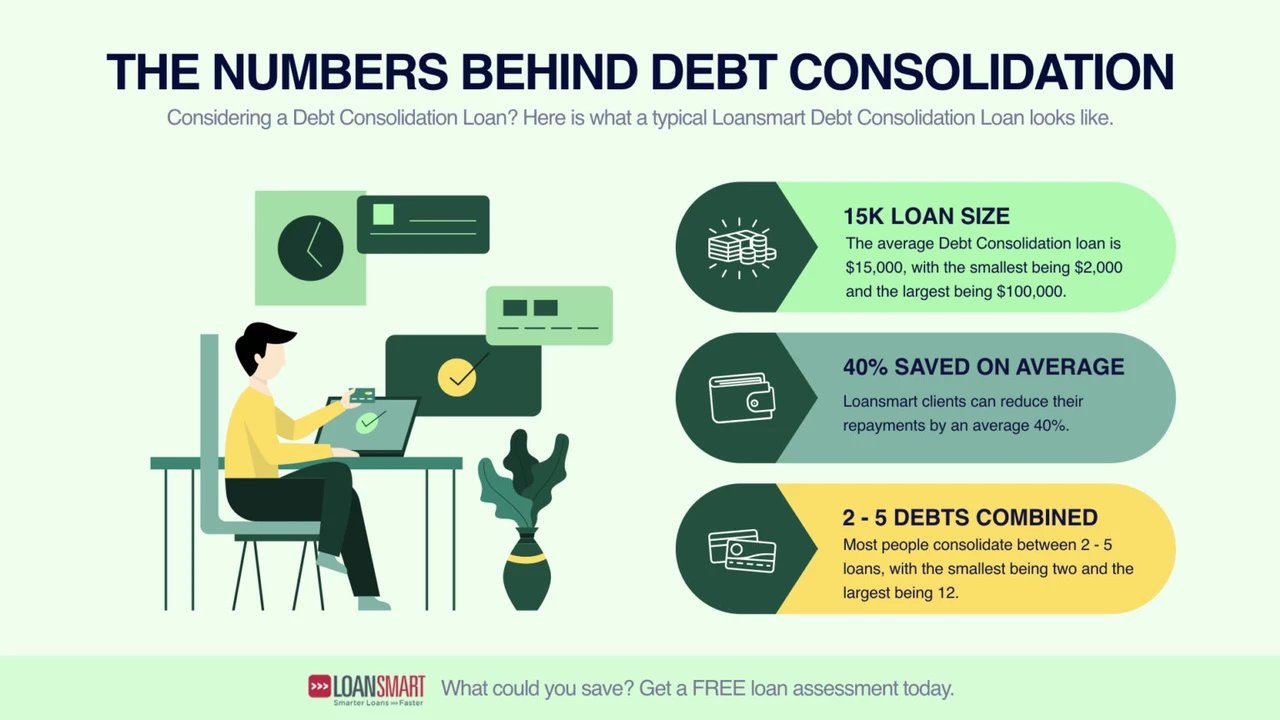

Debt consolidation loans essentially allow you to combine several smaller debts – like credit card balances, personal loans, or even medical bills – into a single, larger loan. This usually comes with a lower interest rate and a single monthly payment, making your financial life much simpler and often saving you a significant amount of money over time. But with so many options out there, how do you pick the right one? That's exactly what we're going to dive into today. We'll compare different types of debt consolidation loans, look at specific products, discuss their pros and cons, and even touch on pricing and ideal use cases.

Understanding Debt Consolidation What It Is and Why It Matters

Before we get into the nitty-gritty of specific loans, let's make sure we're all on the same page about what debt consolidation actually entails. At its core, it's a strategy to streamline your debt repayment. Instead of making separate payments to multiple creditors, you take out a new loan to pay off all those existing debts. Then, you only have one payment to make each month to the new lender.

Why does this matter? Well, for starters, it can significantly reduce the complexity of managing your finances. No more remembering five different due dates or worrying about which card to pay first. More importantly, if you qualify for a lower interest rate on your consolidation loan, you'll pay less in interest over the life of the loan, which means more money stays in your pocket. It can also provide a clear end date for your debt, giving you a tangible goal to work towards. This psychological boost can be incredibly motivating when you're trying to get out of debt.

Types of Debt Consolidation Loans Exploring Your Options

When it comes to consolidating debt, you've got a few main avenues to explore. Each has its own set of characteristics, benefits, and potential drawbacks. Understanding these differences is key to choosing the best path for your unique financial situation.

Personal Loans for Debt Consolidation Unsecured and Flexible

One of the most common and straightforward ways to consolidate debt is through an unsecured personal loan. 'Unsecured' means you don't have to put up any collateral, like your house or car, to get the loan. Your eligibility and interest rate are primarily based on your creditworthiness – your credit score, income, and debt-to-income ratio.

Pros of Personal Loans for Debt Consolidation

- Fixed Interest Rates and Payments: You'll know exactly what you owe each month and for how long, making budgeting much easier.

- No Collateral Required: Your assets aren't at risk if you can't make payments.

- Potentially Lower Interest Rates: If you have good credit, you can often secure a personal loan with a much lower interest rate than high-APR credit cards.

- Quick Funding: Many online lenders can approve and fund personal loans within a few business days.

Cons of Personal Loans for Debt Consolidation

- Credit Score Dependent: If your credit score isn't great, you might not qualify for the best rates, or even for a loan at all.

- Origination Fees: Some lenders charge an upfront fee (typically 1% to 8% of the loan amount) that's deducted from your loan proceeds.

- Temptation to Accumulate New Debt: If you don't address the underlying spending habits, you might pay off your old debts with the loan, only to rack up new ones on your now-empty credit cards.

Recommended Personal Loan Providers for Debt Consolidation

Here are a few popular and reputable lenders offering personal loans for debt consolidation, along with some general insights into their offerings:

-

LightStream:

- Best For: Borrowers with excellent credit (typically 700+ FICO score).

- Key Features: Offers some of the lowest interest rates in the industry, no origination fees, and a wide range of loan amounts and terms. They even have a rate beat program.

- Use Case: If your credit is stellar and you want the absolute lowest rate possible, LightStream is often a top contender.

- Estimated Rates/Fees: APRs can start as low as 6.99% with AutoPay, no origination fees.

-

SoFi:

- Best For: Good to excellent credit borrowers (typically 680+ FICO score) looking for competitive rates and unemployment protection.

- Key Features: No origination fees, unemployment protection (they'll pause payments and help with job search), and a streamlined online application process.

- Use Case: Ideal for professionals with stable income and good credit who want a lender with additional borrower benefits.

- Estimated Rates/Fees: APRs can range from 8.99% to 29.99% with AutoPay, no origination fees.

-

Marcus by Goldman Sachs:

- Best For: Good credit borrowers (typically 660+ FICO score) seeking a straightforward loan with no fees.

- Key Features: No origination fees, no late fees, and no prepayment fees. They offer a personalized rate quote without impacting your credit score.

- Use Case: A solid choice for those who value transparency and want to avoid extra fees.

- Estimated Rates/Fees: APRs can range from 8.99% to 29.99% with AutoPay, no fees.

-

Upgrade:

- Best For: Fair to good credit borrowers (typically 600+ FICO score) who might not qualify for prime rates elsewhere.

- Key Features: Offers loans to a broader range of credit scores, often with competitive rates for their target demographic. They do charge origination fees.

- Use Case: If your credit isn't perfect but you still need a consolidation loan, Upgrade can be a viable option.

- Estimated Rates/Fees: APRs can range from 8.49% to 35.99%, origination fees from 1.85% to 9.99%.

Balance Transfer Credit Cards A Short-Term Solution for High-Interest Debt

Another popular method, especially for credit card debt, is a balance transfer credit card. This involves transferring balances from one or more high-interest credit cards to a new credit card that offers a 0% introductory APR for a specific period (often 12 to 21 months).

Pros of Balance Transfer Credit Cards

- 0% Interest Period: This is the big one! You can pay down your principal without any interest charges during the promotional period.

- Simplicity: Consolidates multiple credit card payments into one.

- No New Loan Application: If you already have good credit, getting approved for a balance transfer card can be easier than a personal loan.

Cons of Balance Transfer Credit Cards

- Balance Transfer Fees: Most cards charge a fee (typically 3% to 5% of the transferred amount) for each balance transferred.

- Limited Time Offer: If you don't pay off the entire balance before the 0% APR period ends, the remaining balance will be subject to a much higher, standard APR.

- Credit Limit Restrictions: The new card's credit limit might not be high enough to cover all your existing balances.

- Credit Score Impact: Opening a new credit card can temporarily ding your credit score, and if you max out the new card, your credit utilization ratio will be high, which also negatively impacts your score.

Recommended Balance Transfer Credit Cards

Here are a few top balance transfer cards, keeping in mind that offers change frequently:

-

Citi Simplicity Card:

- Best For: Those who need a long 0% intro APR period and want to avoid late fees.

- Key Features: Often offers one of the longest 0% intro APR periods on balance transfers (e.g., 21 months). No late fees or penalty APR.

- Use Case: If you're disciplined and confident you can pay off your debt within the intro period, this card gives you ample time.

- Estimated Fees: 3% or 5% balance transfer fee, then a variable APR (e.g., 19.24% - 29.99%) after the intro period.

-

Chase Slate Edge:

- Best For: Good credit borrowers looking for a solid intro offer and potential for APR reduction.

- Key Features: Offers a competitive 0% intro APR on balance transfers (e.g., 18 months). Unique feature: can reduce your APR by 2% each year you pay on time and spend at least $1,000.

- Use Case: Great for those who want to consolidate and potentially lower their long-term interest rate if they carry a balance.

- Estimated Fees: 3% or 5% balance transfer fee, then a variable APR (e.g., 17.99% - 26.74%) after the intro period.

-

BankAmericard Credit Card:

- Best For: Good credit borrowers seeking a straightforward balance transfer option.

- Key Features: Offers a competitive 0% intro APR on balance transfers (e.g., 18 months). No annual fee.

- Use Case: A reliable choice for consolidating credit card debt without any frills.

- Estimated Fees: 3% or 4% balance transfer fee, then a variable APR (e.g., 16.24% - 26.24%) after the intro period.

Home Equity Loans and HELOCs Leveraging Your Home's Value

If you own a home and have built up equity, you might consider using a home equity loan or a Home Equity Line of Credit (HELOC) for debt consolidation. These are secured loans, meaning your home serves as collateral.

Pros of Home Equity Loans/HELOCs

- Lower Interest Rates: Because they're secured by your home, these typically have much lower interest rates than unsecured personal loans or credit cards.

- Tax Deductibility: In some cases, the interest paid on home equity debt can be tax-deductible (consult a tax professional).

- Larger Loan Amounts: You can often borrow larger sums of money compared to personal loans.

Cons of Home Equity Loans/HELOCs

- Risk of Foreclosure: This is the biggest drawback. If you can't make payments, you could lose your home.

- Closing Costs: These loans come with closing costs, similar to a mortgage, which can add to the overall expense.

- Longer Repayment Terms: Repayment periods can be very long (10-30 years), meaning you could be paying off old debt for a long time.

- Variable Rates (HELOCs): HELOCs often have variable interest rates, meaning your monthly payment can fluctuate.

Recommended Home Equity Providers

Home equity products are typically offered by banks and credit unions. It's always best to shop around with multiple lenders, including your current mortgage provider.

-

Bank of America:

- Best For: Existing Bank of America customers or those seeking a large, established lender.

- Key Features: Offers both home equity loans and HELOCs with competitive rates and potential discounts for existing customers.

- Use Case: If you have significant equity and are comfortable using your home as collateral for a large consolidation amount.

- Estimated Rates/Fees: Rates vary widely based on credit, LTV, and market conditions. Expect closing costs.

-

Wells Fargo:

- Best For: Homeowners looking for a wide range of options and personalized service.

- Key Features: Offers both fixed-rate home equity loans and variable-rate HELOCs.

- Use Case: Similar to Bank of America, good for those with substantial home equity.

- Estimated Rates/Fees: Rates vary. Expect closing costs.

-

Local Credit Unions:

- Best For: Borrowers seeking personalized service and potentially lower fees.

- Key Features: Credit unions often offer very competitive rates and more flexible terms to their members.

- Use Case: Always check with your local credit union; they can often beat larger banks.

- Estimated Rates/Fees: Highly variable by institution.

Debt Consolidation vs Debt Management Plans and Debt Settlement

It's crucial to distinguish debt consolidation from other debt relief options, as they are very different and suitable for different situations.

Debt Management Plans (DMPs)

A Debt Management Plan is typically offered by non-profit credit counseling agencies. They negotiate with your creditors to lower your interest rates and waive fees, then combine your payments into one monthly payment to the agency, which then distributes the funds to your creditors. You don't take out a new loan.

Pros of DMPs

- Lower Interest Rates: Creditors often agree to lower rates for DMPs.

- Structured Repayment: One monthly payment makes it easier to manage.

- Credit Counseling: You receive guidance on budgeting and financial habits.

Cons of DMPs

- Fees: Agencies may charge setup and monthly fees.

- Credit Impact: While not as severe as debt settlement, DMPs can be noted on your credit report.

- Credit Card Restrictions: You typically have to close all enrolled credit card accounts.

Debt Settlement

Debt settlement involves negotiating with creditors to pay back less than the full amount you owe. This is usually done through a for-profit company that holds your payments in an escrow account until they've accumulated enough to make a lump-sum offer to your creditors.

Pros of Debt Settlement

- Pay Less Than You Owe: The primary appeal is reducing the total amount of debt.

Cons of Debt Settlement

- Severe Credit Damage: This is the most damaging option to your credit score, often staying on your report for seven years.

- Fees: Settlement companies charge substantial fees, often a percentage of the settled debt.

- Tax Implications: The forgiven debt might be considered taxable income.

- No Guarantee: Creditors are not obligated to settle, and you could face lawsuits.

Choosing the Right Debt Consolidation Loan for You Key Factors

With all these options, how do you make the best decision? It boils down to a few critical factors:

Your Credit Score The Ultimate Gatekeeper

Your credit score is arguably the most important factor. A higher score (generally 670+) will open doors to lower interest rates on personal loans and better balance transfer card offers. If your score is lower, your options might be more limited or come with higher rates.

Interest Rates and Fees Don't Just Look at the APR

While the Annual Percentage Rate (APR) is crucial, don't forget about other fees. Origination fees on personal loans, balance transfer fees on credit cards, and closing costs on home equity products can significantly impact the total cost of your consolidation. Always calculate the total cost over the life of the loan.

Loan Term and Monthly Payments Finding the Right Balance

A longer loan term usually means lower monthly payments, but you'll pay more in interest over time. A shorter term means higher monthly payments but less interest overall. Find a balance that fits comfortably within your budget without extending your debt repayment unnecessarily.

Secured vs Unsecured Risk Assessment

Are you comfortable putting your home at risk to secure a lower interest rate? For many, the answer is no, making unsecured personal loans or balance transfer cards more appealing. Weigh the potential savings against the risk involved.

Your Spending Habits Addressing the Root Cause

This is perhaps the most important, yet often overlooked, factor. Debt consolidation is a tool, not a magic bullet. If you don't address the underlying spending habits that led to your debt in the first place, you'll likely find yourself in the same situation again, possibly with even more debt. Use consolidation as an opportunity to reset your financial habits, create a strict budget, and stick to it.

The Application Process What to Expect

Once you've decided on a type of loan and a specific lender, the application process is generally straightforward:

- Check Your Credit Score: Get a free copy of your credit report and score. This helps you understand what rates you might qualify for.

- Gather Documents: You'll typically need proof of income (pay stubs, tax returns), identification (driver's license), and details of the debts you want to consolidate.

- Apply Online: Most lenders offer online applications that can be completed in minutes.

- Receive Offers: Lenders will review your application and provide you with loan offers, including interest rates and terms.

- Review and Accept: Carefully read all terms and conditions before accepting an offer.

- Fund Disbursement: Once accepted, the funds are usually disbursed directly to your bank account or, in some cases, directly to your creditors.

Common Pitfalls to Avoid When Consolidating Debt

While debt consolidation can be a lifesaver, there are some traps you'll want to steer clear of:

- Not Addressing Spending Habits: As mentioned, this is the biggest one. If you don't change your financial behavior, you'll just dig a deeper hole.

- High Fees: Be wary of loans with excessive origination fees or balance transfer fees that eat into your savings.

- Extending the Loan Term Too Much: While lower payments are nice, a very long loan term means you'll pay more interest overall.

- Ignoring Your Credit Score: Don't apply for loans you're unlikely to qualify for, as multiple hard inquiries can temporarily lower your score.

- Falling for Scams: Be cautious of companies promising unrealistic results or asking for upfront fees before providing any service. Stick to reputable lenders.

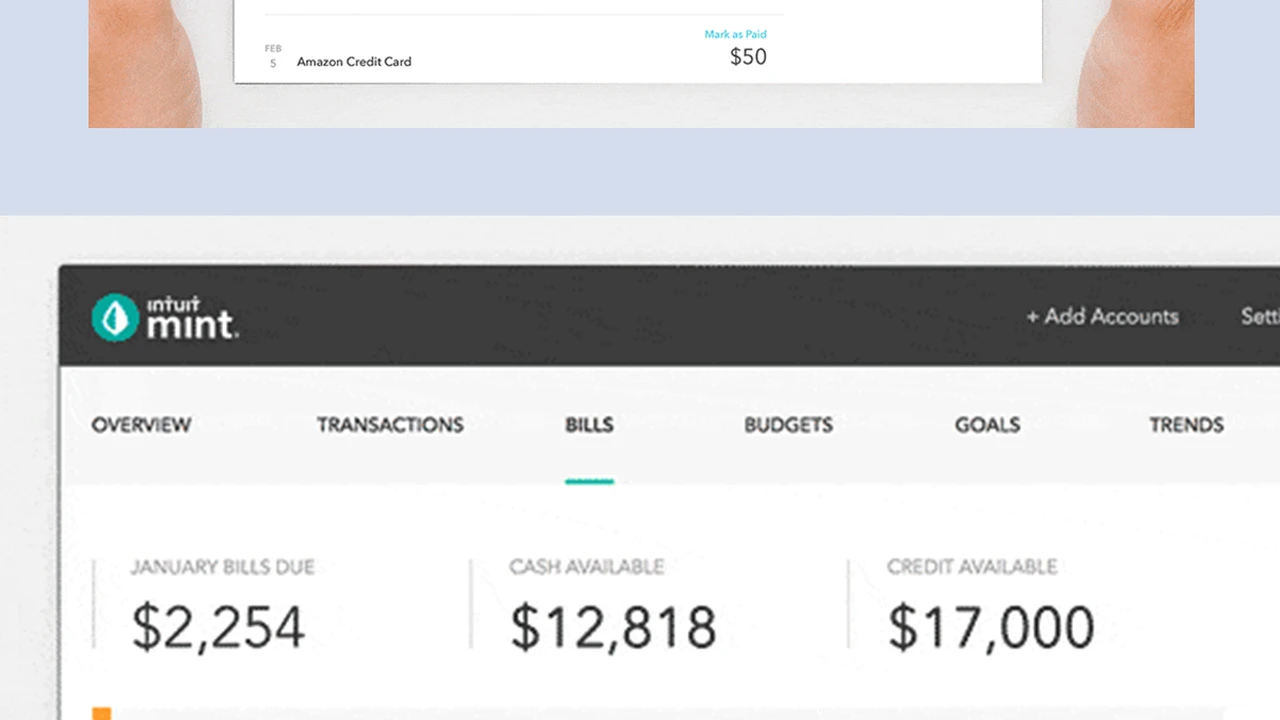

Making Debt Consolidation Work for You A Strategic Approach

To truly benefit from debt consolidation, approach it strategically. First, create a detailed budget to understand where your money is going. Identify areas where you can cut back to free up more cash for debt repayment. Second, once your debts are consolidated, resist the urge to use your now-empty credit cards. Consider cutting them up or freezing them if temptation is an issue. Third, set up automatic payments for your new consolidation loan to avoid missing payments and incurring late fees. Finally, regularly review your financial progress. Celebrate small victories and stay motivated on your journey to becoming debt-free.

Debt consolidation isn't a magic wand, but it's a powerful tool that, when used wisely, can significantly simplify your financial life, reduce your interest payments, and put you on a clear path to financial freedom. Do your homework, compare your options, and choose the solution that best fits your unique situation. You've got this!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)