5 Best Budgeting Apps for US Households

Compare the top 5 budgeting apps designed for US users to track spending, set financial goals, and save money effectively.

5 Best Budgeting Apps for US Households

Hey there, money-savvy folks! Are you tired of wondering where all your hard-earned cash goes each month? Do you dream of a world where your savings grow effortlessly and your financial goals feel within reach? Well, you're in luck! In today's digital age, managing your money has never been easier, thanks to a plethora of fantastic budgeting apps. For US households, these apps can be a game-changer, helping you track spending, identify areas for savings, and ultimately achieve financial peace of mind. But with so many options out there, how do you pick the right one? Don't sweat it! We've done the heavy lifting for you, diving deep into the features, pros, and cons of the five best budgeting apps specifically tailored for US users. Let's get your finances in tip-top shape!

Why Use a Budgeting App for Your US Household Finances?

Before we jump into the nitty-gritty of specific apps, let's quickly chat about why a budgeting app is an absolute must-have for any US household. Think of it this way: your money is like a garden. Without proper care and attention, weeds (unnecessary expenses) can take over, and your beautiful flowers (savings and investments) might wither. A budgeting app acts as your personal gardener, helping you cultivate a thriving financial landscape. Here's why they're so beneficial:

- Spending Tracking Made Easy: Manually logging every transaction is a pain. These apps automatically categorize your spending, giving you a clear picture of where your money is going.

- Goal Setting and Achievement: Want to save for a down payment, a dream vacation, or retirement? Budgeting apps help you set realistic goals and track your progress.

- Debt Management Tools: Many apps offer features to help you tackle debt, whether it's credit card debt, student loans, or a mortgage.

- Financial Awareness and Control: When you see your money laid out clearly, you gain a sense of control and make more informed financial decisions.

- Automation and Reminders: Set up recurring budgets, bill reminders, and automatic savings transfers to keep your finances on track without constant effort.

- Security and Privacy: Reputable apps use bank-level encryption to protect your financial data, giving you peace of mind.

Ready to transform your financial habits? Let's explore the top contenders!

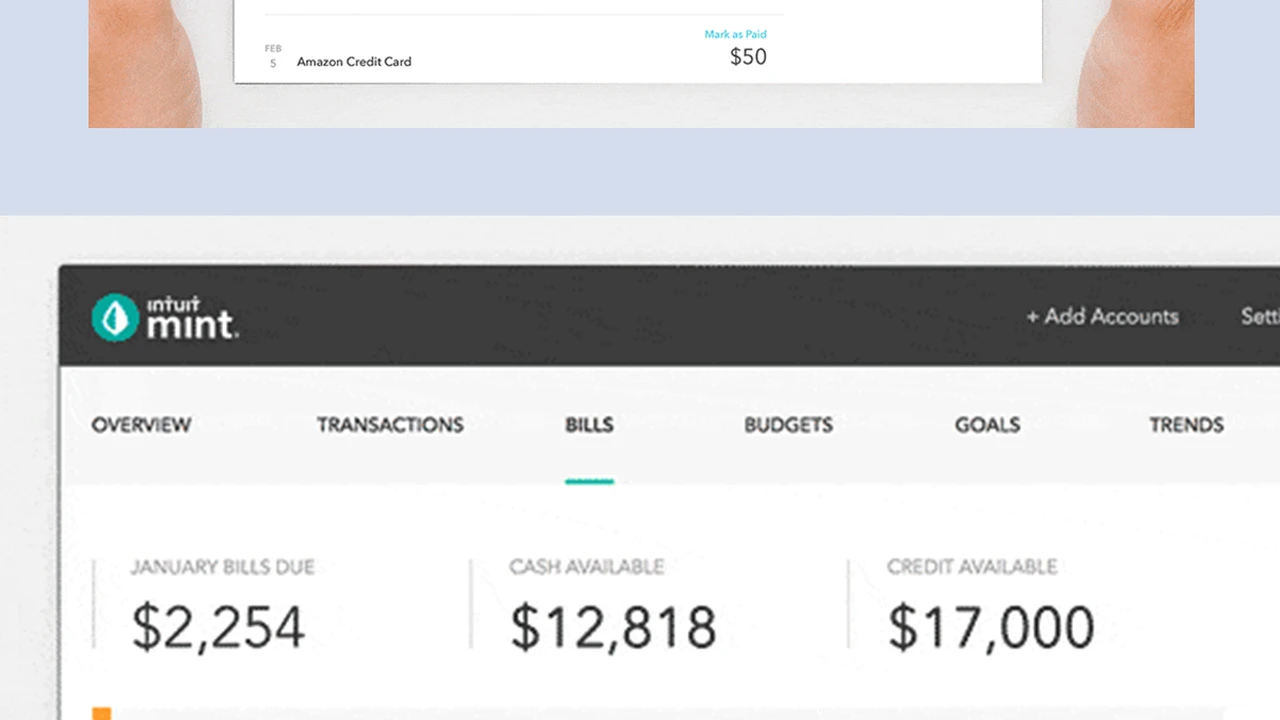

Mint The Free All-in-One Budgeting Solution for US Users

Mint has long been a household name in the personal finance world, and for good reason. It's a free, comprehensive budgeting app that connects to all your financial accounts – bank accounts, credit cards, loans, and investments – to give you a holistic view of your money. Intuit, the company behind TurboTax and QuickBooks, developed Mint, so you know it's backed by serious financial tech expertise.

Key Features of Mint for US Households:

- Automatic Transaction Categorization: Mint automatically pulls in your transactions and categorizes them, though you can easily customize or re-categorize as needed. This is a huge time-saver!

- Budget Creation and Tracking: Set up custom budgets for different spending categories (groceries, entertainment, utilities, etc.) and Mint will show you how much you have left to spend in each category.

- Bill Tracking and Reminders: Connect your bills, and Mint will remind you when they're due, helping you avoid late fees and maintain a good credit score.

- Credit Score Monitoring: Get your free credit score and insights into factors affecting it, a valuable tool for US consumers.

- Net Worth Tracking: See your total financial picture, including assets and liabilities, to track your net worth over time.

- Investment Tracking: Monitor your investment accounts alongside your everyday spending, giving you a complete financial overview.

- Financial Goal Setting: Set goals for saving, debt repayment, or retirement, and Mint helps you visualize your progress.

User Scenarios and Benefits:

Mint is perfect for US households that want a robust, free solution to manage all aspects of their finances in one place. If you're a busy parent trying to juggle household expenses, a young professional looking to get a handle on student loan debt, or someone simply wanting to see where their money goes, Mint offers an intuitive interface and powerful features. Its automatic categorization is a huge plus for those who don't want to spend hours manually inputting data. The credit score monitoring is a fantastic bonus, especially for those looking to improve their financial standing.

Pricing:

Mint is completely free to use. It generates revenue through advertisements for financial products (like credit cards, loans, and investment services) that it believes might be relevant to your financial situation. While these ads are present, they are generally unobtrusive and don't hinder the core functionality of the app.

You Need A Budget YNAB The Budgeting Philosophy for Intentional Spending

You Need A Budget, affectionately known as YNAB, isn't just an app; it's a budgeting philosophy. YNAB operates on four core rules designed to help you gain total control over your money: Give Every Dollar a Job, Embrace Your True Expenses, Roll With the Punches, and Age Your Money. It's a more hands-on approach than Mint, but its devotees swear by its effectiveness in transforming financial habits.

Key Features of YNAB for US Households:

- Zero-Based Budgeting: Every dollar you earn is assigned a purpose (a 'job') before you spend it. This proactive approach ensures no money is left unaccounted for.

- Goal-Oriented Budgeting: YNAB excels at helping you save for specific goals, whether it's a large purchase, an emergency fund, or annual expenses.

- True Expenses (Sinking Funds): It encourages you to budget for irregular, larger expenses (like car insurance, holiday gifts, or home repairs) by setting aside small amounts each month.

- Transaction Import and Manual Entry: You can link your bank accounts for automatic import, but YNAB also encourages manual entry for greater awareness and control.

- Detailed Reporting: Get insightful reports on your spending, net worth, and income vs. expense trends.

- Debt Paydown Tools: YNAB's framework naturally supports debt repayment by allowing you to allocate funds specifically to debt categories.

- Educational Resources: YNAB offers extensive free workshops, guides, and a supportive community to help you master their budgeting method.

User Scenarios and Benefits:

YNAB is ideal for US households that are serious about changing their financial behavior and are willing to invest a bit more time and effort into their budgeting. If you've struggled with overspending, living paycheck to paycheck, or simply want to be more intentional with your money, YNAB's philosophy can be incredibly powerful. It's particularly beneficial for those who want to break free from the 'month-to-month' cycle and start 'aging their money' (meaning your current spending comes from money earned in a previous month). While it has a learning curve, the financial clarity and control it provides are often cited as life-changing by its users.

Pricing:

YNAB offers a 34-day free trial, which is ample time to get a feel for the system and see if it works for you. After the trial, it costs $14.99 per month or $99 per year (which breaks down to about $8.25 per month). While it's a paid app, many users find that the savings and financial control they gain far outweigh the subscription cost.

Personal Capital Empower Your Investments and Net Worth for US Investors

Personal Capital (now Empower Personal Wealth) stands out from other budgeting apps because it focuses heavily on wealth management, investment tracking, and retirement planning, in addition to basic budgeting. It's particularly well-suited for US households with investments, multiple accounts, and a desire for a comprehensive view of their entire financial portfolio.

Key Features of Personal Capital for US Households:

- Robust Net Worth Tracker: This is where Personal Capital truly shines. It aggregates all your financial accounts – checking, savings, credit cards, mortgages, 401(k)s, IRAs, brokerage accounts, and even real estate – to give you an accurate, real-time net worth calculation.

- Investment Performance Tracking: Monitor the performance of all your investments in one dashboard, analyze asset allocation, and identify potential areas for optimization.

- Retirement Planner: Use their powerful retirement planner to project your financial future, test different scenarios, and ensure you're on track for your retirement goals.

- Fee Analyzer: Discover hidden fees in your investment accounts that could be eating into your returns. This feature alone can save you thousands over time.

- Cash Flow Tracking: While not as granular as Mint or YNAB for daily budgeting, it provides a good overview of your income and expenses.

- Financial Advisor Access (Optional): For users with higher asset levels (typically $100,000+), Personal Capital offers personalized financial advisory services, though this comes with additional fees.

User Scenarios and Benefits:

Personal Capital is an excellent choice for US households that have moved beyond basic budgeting and are now focused on growing their wealth and planning for the long term. If you have a diverse investment portfolio, multiple retirement accounts, or simply want a sophisticated tool to track your net worth and investment performance, Personal Capital is hard to beat. It's particularly valuable for those approaching retirement or those with significant assets who want to ensure their investments are aligned with their goals. While it offers some budgeting features, its strength lies in its wealth management capabilities.

Pricing:

The core Personal Capital app, including the net worth tracker, investment analyzer, and retirement planner, is completely free. They make money through their optional wealth management services, where they charge a percentage of assets under management (typically 0.89% for the first $1 million, with rates decreasing for higher asset levels). You are under no obligation to use their advisory services to enjoy the free tools.

Simplifi by Quicken The Streamlined Budgeting App for US Families

Simplifi by Quicken is a newer player in the budgeting app space, designed to offer a more streamlined and modern experience compared to Quicken's traditional desktop software. It aims to provide a clear, real-time view of your money without the complexity often associated with comprehensive financial tools. It's a great option for US households looking for a balance between automated tracking and actionable insights.

Key Features of Simplifi for US Households:

- Real-Time Spending Tracking: Connects to your bank accounts and credit cards to automatically track and categorize your spending in real-time.

- Customizable Spending Plan: Create a personalized spending plan based on your income and expenses, with alerts if you're approaching your limits.

- Subscription Tracking: Simplifi automatically identifies and tracks your recurring subscriptions, helping you spot and cancel unwanted services.

- Savings Goals: Set specific savings goals and track your progress, making it easier to save for big purchases or emergencies.

- Net Worth Tracking: Get a consolidated view of your assets and liabilities to monitor your net worth over time.

- Projected Cash Flow: See a projection of your cash flow for the month, helping you anticipate future balances and avoid overdrafts.

- No Ads: Unlike some free apps, Simplifi is ad-free, providing a cleaner user experience.

User Scenarios and Benefits:

Simplifi is an excellent choice for US households that want a modern, intuitive budgeting app without the steep learning curve of some other options. If you appreciate automation but also want to be actively involved in your spending plan, Simplifi strikes a good balance. It's particularly useful for families who want to keep tabs on their monthly subscriptions, track savings goals, and get a clear picture of their projected cash flow. Its ad-free experience is a definite plus for those who prefer an uncluttered interface.

Pricing:

Simplifi by Quicken offers a 30-day free trial. After the trial, it costs $3.99 per month (billed annually at $47.88) or $5.99 per month (billed monthly). This makes it one of the more affordable paid options, especially if you commit to an annual plan.

Honeydue The Best Budgeting App for Couples and Joint Finances in the US

Managing money as a couple can be tricky, but Honeydue makes it a whole lot easier. This app is specifically designed for couples to manage their finances together, offering transparency, shared budgeting tools, and individual privacy where needed. It's perfect for US households where two people are contributing to and managing shared expenses.

Key Features of Honeydue for US Households:

- Shared Accounts and Transactions: Link your bank accounts and credit cards, and choose which accounts to share with your partner. You can see all shared transactions in one place.

- Customizable Budgets for Couples: Create shared spending categories and set budgets together. You can also track who spent what in each category.

- Bill Reminders and Split Bills: Get reminders for upcoming bills and easily split expenses with your partner, making sure everyone contributes fairly.

- Individual Account Privacy: While you can share accounts, Honeydue also allows for private accounts, so you can keep some spending personal if you wish.

- Chat Functionality: Communicate directly within the app about finances, making it easy to discuss spending, goals, and upcoming bills.

- Net Worth Tracking (Shared): See your combined net worth, giving you a clear picture of your joint financial health.

- Emoji Reactions: A fun, lighthearted way to react to transactions, adding a bit of personality to your financial discussions.

User Scenarios and Benefits:

Honeydue is a godsend for US couples who want to manage their finances collaboratively and transparently. If you and your partner are combining finances, splitting bills, or working towards shared financial goals, Honeydue provides the tools to do so without awkward conversations or confusion. It's particularly helpful for new couples moving in together, married couples managing a household budget, or even roommates who want to split shared expenses fairly. The ability to maintain some individual privacy while still sharing core financial information is a huge advantage.

Pricing:

Honeydue is completely free to use. Like Mint, it generates revenue through partnerships and offers for financial products, but its core budgeting and tracking features are free for couples.

Comparing the Best Budgeting Apps for US Households A Quick Look

To help you make a decision, here's a quick comparison table summarizing the key aspects of these top 5 budgeting apps for US households:

| App Name | Best For | Key Differentiator | Pricing | Pros | Cons |

|---|---|---|---|---|---|

| Mint | Free all-in-one budgeting, credit score monitoring | Comprehensive free features, credit score, investment tracking | Free | Free, easy to use, automatic categorization, credit score, net worth | Ads, less hands-on budgeting, occasional sync issues |

| YNAB | Intentional spending, debt repayment, financial transformation | Zero-based budgeting philosophy, proactive money management | $14.99/month or $99/year | Highly effective for changing habits, detailed control, strong community | Paid, steep learning curve, requires commitment |

| Personal Capital | Wealth management, investment tracking, retirement planning | Robust net worth and investment analysis, fee analyzer | Free (core app) | Excellent for investors, comprehensive net worth, retirement planner | Less granular daily budgeting, advisory services are paid |

| Simplifi by Quicken | Streamlined budgeting, subscription tracking, projected cash flow | Modern interface, ad-free, good balance of automation and control | $3.99/month (annual) or $5.99/month | Clean interface, ad-free, subscription tracking, projected cash flow | Paid, not as feature-rich as YNAB for deep budgeting |

| Honeydue | Couples and joint finances | Designed specifically for shared finances, individual privacy options | Free | Free, great for couples, shared budgets, bill splitting, private accounts | Less robust for individual budgeting, limited investment tracking |

Choosing the Right Budgeting App for Your US Household Needs

So, how do you pick the perfect budgeting app from this fantastic lineup? It really boils down to your specific needs, financial goals, and how you prefer to manage your money. Here are some questions to ask yourself:

- What's your budget? If you're looking for a completely free solution, Mint or Honeydue are excellent choices. If you're willing to pay for more advanced features or a specific methodology, YNAB or Simplifi might be better. Personal Capital's core features are free, but its advisory services are paid.

- What's your primary goal? Are you trying to get out of debt (YNAB)? Track all your investments (Personal Capital)? Simply see where your money goes (Mint, Simplifi)? Or manage money with a partner (Honeydue)?

- How hands-on do you want to be? YNAB requires more active participation and adherence to its philosophy. Mint and Simplifi offer more automation.

- Are you managing money with a partner? If so, Honeydue is specifically built for you.

- Do you have significant investments? Personal Capital is unparalleled for investment tracking and wealth management.

- Do you prefer an ad-free experience? Simplifi offers this for a fee, while Mint and Honeydue are free but include ads.

Many of these apps offer free trials, so don't hesitate to download a couple and test them out. See which interface you like best, which features resonate with your financial habits, and which one feels most intuitive for your US household's unique situation. Remember, the best budgeting app is the one you'll actually use consistently!

Tips for Maximizing Your Budgeting App Experience for US Households

Once you've chosen your champion budgeting app, here are some pro tips to ensure you get the most out of it and truly transform your financial life:

- Connect All Your Accounts: The more accounts you link (checking, savings, credit cards, loans, investments), the more accurate and comprehensive your financial picture will be.

- Customize Categories: While apps do a good job of auto-categorizing, take the time to review and adjust categories to match your actual spending habits and priorities. This makes reports much more meaningful.

- Set Realistic Budgets: Don't cut everything to the bone immediately. Start with realistic budgets, and then gradually tighten them as you become more comfortable and identify areas for savings.

- Review Regularly: Make it a habit to check your app at least once a week, if not daily. This helps you stay on top of your spending and make adjustments before you overspend.

- Set Financial Goals: Whether it's an emergency fund, a down payment, or retirement, having clear goals will motivate you to stick to your budget.

- Automate Savings: Many apps integrate with savings tools or allow you to set up automatic transfers to your savings accounts. 'Pay yourself first' is a golden rule!

- Be Patient: Changing financial habits takes time. Don't get discouraged if you go over budget occasionally. Learn from it, adjust, and keep moving forward.

- Utilize Reports: Dive into the reports and graphs your app provides. They offer valuable insights into your spending patterns and financial health over time.

By consistently using your chosen budgeting app and applying these tips, you'll be well on your way to achieving your financial dreams. Happy budgeting, US households!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)