Understanding the Impact of Late Payments on Your US Credit Score

Learn how late payments affect your credit score in the US and strategies to avoid them.

Understanding the Impact of Late Payments on Your US Credit Score

Hey there! Let's talk about something super important for your financial health in the US: late payments and your credit score. It's one of those things that can sneak up on you, but its impact can be pretty significant. We're going to dive deep into how a late payment can ding your credit, what factors determine just how bad that ding is, and most importantly, how you can avoid them altogether. Think of this as your friendly guide to keeping your credit score in tip-top shape.

The Immediate Hit How Late Payments Affect Your Credit Score

So, you missed a payment. Maybe it was an honest mistake, or perhaps things got a little tight. Whatever the reason, once that payment is 30 days past due, it's likely going to show up on your credit report. And when it does, it's not good news. Your payment history is the single most important factor in your FICO score, accounting for a whopping 35% of it. That's a huge chunk! A single late payment can cause your score to drop significantly, especially if you have an otherwise excellent credit history. For someone with a high credit score (say, 780+), a 30-day late payment could knock off 90 to 110 points. Ouch! If your score is already lower, the impact might be less dramatic in terms of points, but it still hurts your overall creditworthiness.

Why 30 Days Matters The Reporting Threshold for Credit Bureaus

It's crucial to understand that a payment isn't typically reported as 'late' to the credit bureaus (Experian, Equifax, and TransUnion) until it's at least 30 days past its due date. This means if you're a few days late, or even a couple of weeks, you usually have a grace period to catch up before it hits your credit report. However, your lender might still charge you a late fee, which is a separate issue from your credit score. Always check your loan or credit card agreement for their specific late payment policies and grace periods. Once that 30-day mark passes, your lender will report it to the credit bureaus, and that's when the real damage begins.

Long Term Consequences The Lingering Effects of a Late Payment on Your Credit History

Unfortunately, the impact of a late payment isn't just a one-time hit. It can stick around on your credit report for up to seven years. While its impact lessens over time, especially as you establish a new pattern of on-time payments, it will still be visible to potential lenders. This means that for years, a late payment could make it harder to get approved for new credit, secure favorable interest rates on loans (like mortgages or car loans), or even rent an apartment. Some employers also check credit reports, so it could even affect job opportunities, especially in financially sensitive roles.

Interest Rates and Loan Approvals How Late Payments Impact Your Borrowing Power

One of the most direct consequences of a lower credit score due to late payments is higher interest rates. Lenders view individuals with a history of late payments as higher risk. To compensate for this perceived risk, they'll offer you loans with higher interest rates. Over the life of a mortgage or car loan, this can cost you thousands, even tens of thousands, of dollars extra. For example, if you're looking to buy a house, a lower credit score could mean the difference between a 3% interest rate and a 5% interest rate, significantly increasing your monthly payments and the total cost of the home. Similarly, getting approved for new credit cards, personal loans, or even refinancing existing debt can become much more challenging or come with less attractive terms.

Factors Influencing the Severity of the Impact Understanding What Makes a Late Payment Worse

Not all late payments are created equal. Several factors can influence how severely a late payment affects your credit score. Understanding these can help you gauge the potential damage and prioritize your financial recovery.

How Late Is Too Late The 30 60 90 Day Thresholds

The longer a payment is past due, the worse the impact on your credit score. A 30-day late payment is bad, but a 60-day late payment is worse, and a 90-day late payment is even more detrimental. Each subsequent reporting of a later payment (e.g., from 30 to 60 days, then 60 to 90 days) will cause additional drops in your score. If a payment goes 120 days or more past due, the account might be charged off, meaning the lender has given up on collecting the debt and sold it to a collection agency. A charge-off is one of the most severe negative marks on your credit report.

Your Overall Credit History The Context of Your Payment Behavior

If you have a long history of perfect on-time payments, a single 30-day late payment might not be as devastating as it would be for someone with an already spotty credit history. Lenders and credit scoring models look at your overall payment behavior. A single isolated incident is less concerning than a pattern of missed payments. However, even for those with excellent credit, it's still a significant blow.

The Type of Account Which Accounts Are Most Sensitive to Late Payments

Late payments on certain types of accounts can have a more pronounced effect. For instance, missing a payment on a mortgage or an auto loan, which are typically larger debts, can be seen as more serious than missing a payment on a small retail credit card. However, any late payment on any type of credit account can negatively impact your score.

Strategies to Avoid Late Payments Proactive Steps for Financial Health

The best defense is a good offense, right? When it comes to late payments, being proactive is key. Here are some practical strategies to help you stay on top of your bills and protect your credit score.

Automate Your Payments Setting Up Autopay for Bills

This is probably the easiest and most effective way to avoid late payments. Most banks and creditors offer automatic payment options. You can set up recurring payments from your checking account to cover your credit card bills, loan payments, and utilities. Just make sure you have enough funds in your account to cover the payments when they're due. It's a set-it-and-forget-it solution that can save you a lot of headaches.

Set Up Reminders Using Calendars and Apps to Track Due Dates

If you're not comfortable with autopay, or for bills that fluctuate, setting up reminders is a great alternative. Use your phone's calendar, a dedicated budgeting app, or even a simple spreadsheet to track all your due dates. Set reminders a few days before each payment is due, giving you ample time to make the payment manually. Many credit card companies and banks also offer email or text message alerts when a payment is approaching or if it's past due.

Create a Budget and Stick to It Understanding Your Cash Flow

A solid budget is the foundation of good financial management. By tracking your income and expenses, you'll know exactly how much money you have available for bills and other necessities. This helps prevent situations where you might not have enough funds to cover a payment. There are tons of great budgeting tools out there, both free and paid, that can help you get started.

Recommended Budgeting Tools for US Consumers

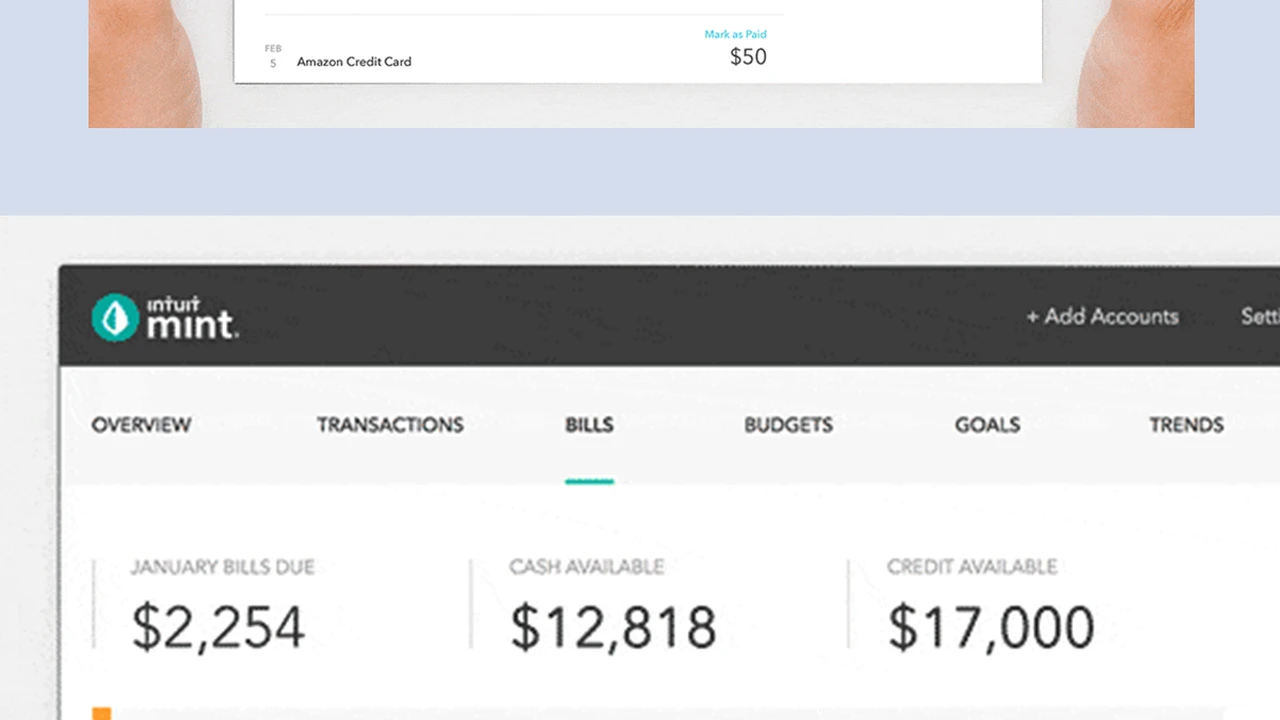

- Mint (Free): This popular app connects to all your financial accounts, categorizes your spending, and helps you create budgets. It's great for seeing all your finances in one place.

- You Need A Budget (YNAB) ($14.99/month or $99/year, free trial available): YNAB uses a zero-based budgeting approach, meaning every dollar has a job. It's fantastic for those who want a more hands-on approach to managing their money and preventing overspending.

- Personal Capital (Free for basic tools): While known for investment tracking, Personal Capital also offers excellent budgeting and cash flow analysis tools, giving you a holistic view of your financial life.

- Fidelity Full View (Free for Fidelity customers): If you have accounts with Fidelity, their Full View tool offers comprehensive budgeting and financial planning features, aggregating all your external accounts.

Adjust Due Dates Aligning Payments with Your Pay Schedule

Many creditors are willing to adjust your payment due date to better align with your pay schedule. For example, if you get paid on the 1st and 15th of the month, you might want your credit card payment due around the 5th or 20th. This can make it easier to ensure you have funds available when payments are due. Just call your creditor and ask; it's often a simple process.

Build an Emergency Fund A Safety Net for Unexpected Expenses

Sometimes, late payments happen not because of forgetfulness, but because of unexpected expenses that drain your available cash. Having an emergency fund – typically 3 to 6 months' worth of living expenses saved in an easily accessible account – can be a lifesaver. If your car breaks down or you face an unexpected medical bill, you can tap into your emergency fund instead of missing a credit card payment.

What to Do If You've Already Made a Late Payment Damage Control and Recovery

Okay, so the deed is done. You've made a late payment, and it's been reported. Don't despair! While you can't erase it immediately, there are steps you can take to mitigate the damage and start rebuilding your credit.

Contact Your Creditor Immediately Explaining Your Situation

As soon as you realize you've missed a payment, call your creditor. Explain what happened. If this is your first late payment with them and you have a good payment history, they might be willing to offer you a one-time goodwill adjustment and remove the late payment from your credit report. It's not guaranteed, but it's definitely worth asking. Be polite, explain your situation, and emphasize your commitment to making future payments on time.

Pay the Overdue Amount as Soon as Possible Minimizing Further Damage

Even if it's already been reported as 30 days late, pay the overdue amount as quickly as you can. This prevents the payment from becoming 60 or 90 days late, which would cause even more damage to your score. Getting back on track with on-time payments immediately is crucial for showing lenders you're responsible.

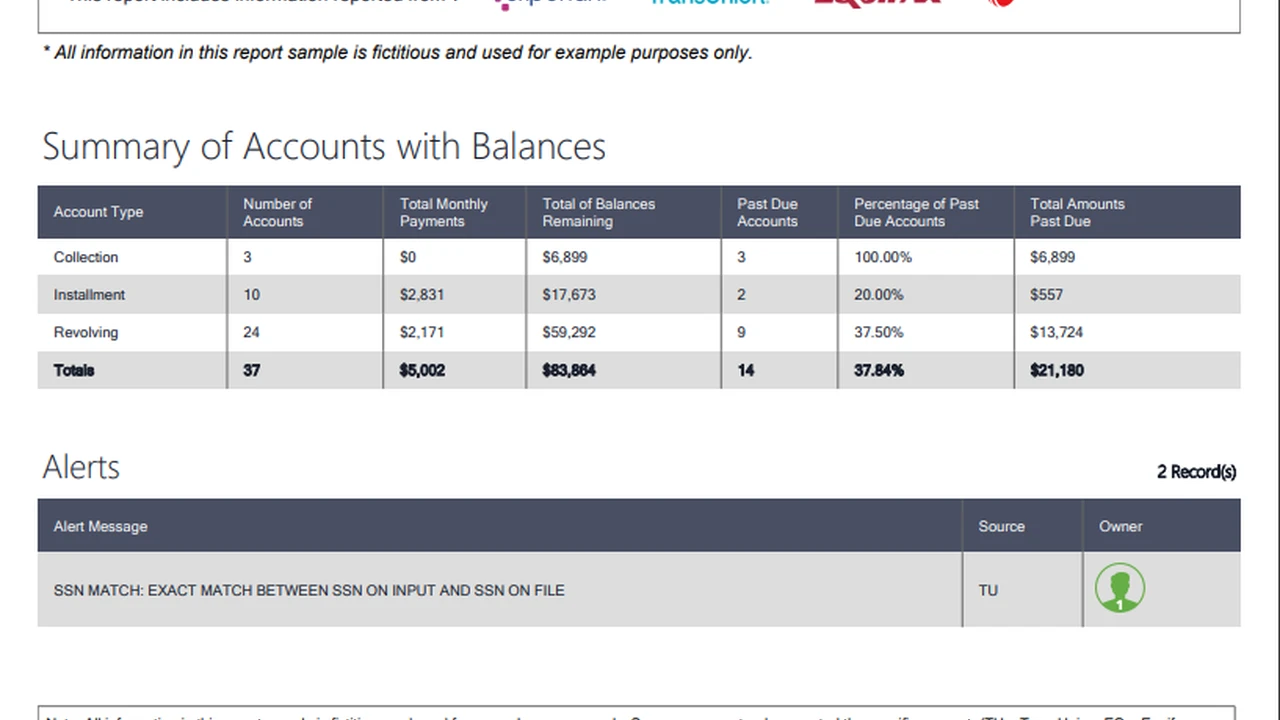

Check Your Credit Report for Accuracy Monitoring for Errors

After a late payment, it's a good idea to check your credit report from all three major bureaus (Experian, Equifax, and TransUnion) to ensure the information reported is accurate. You can get a free copy of your credit report from each bureau once a year at AnnualCreditReport.com. Look for the late payment entry and verify the date and amount. If you find any inaccuracies, dispute them immediately with the credit bureau.

Recommended Credit Monitoring Services for US Consumers

- Credit Karma (Free): Offers free credit scores (VantageScore 3.0) and reports from TransUnion and Equifax, along with monitoring and alerts. Great for general oversight.

- Experian (Free Basic, Premium $24.99/month): Provides your Experian FICO score and report, with the premium version offering daily FICO score updates and more robust monitoring.

- myFICO ($39.95/month for 3-bureau monitoring): If you want to see your actual FICO scores from all three bureaus, myFICO is the most comprehensive option, offering various FICO score versions used by lenders.

- Identity Guard (Starts at $7.50/month): Focuses on identity theft protection but often includes credit monitoring and alerts as part of its packages.

Focus on Consistent On-Time Payments Rebuilding Your Credit History

The best way to recover from a late payment is to establish a consistent pattern of on-time payments moving forward. The further in the past the late payment is, and the more on-time payments you make since then, the less impact it will have on your score. Time and consistent positive behavior are your best allies in credit repair.

Consider a Secured Credit Card or Credit Builder Loan for Rebuilding

If your credit score has taken a significant hit, you might find it challenging to get approved for traditional credit. In such cases, a secured credit card or a credit builder loan can be excellent tools for rebuilding. A secured credit card requires a cash deposit, which acts as your credit limit. You use it like a regular credit card, and your on-time payments are reported to the credit bureaus. A credit builder loan is a small loan where the funds are held in a savings account until you've made all your payments, also reporting your payment history. Both are designed to help you demonstrate responsible credit behavior.

Recommended Secured Credit Cards and Credit Builder Loans

- Discover it Secured Credit Card (No annual fee): A popular choice, it offers cash back rewards and transitions to an unsecured card after responsible use.

- Capital One Platinum Secured Credit Card (No annual fee): Another solid option, it may require a lower security deposit for some applicants.

- Chime Credit Builder Visa® Credit Card (No annual fee, no credit check): This card is unique as it doesn't require a security deposit; instead, you move money from your Chime checking account to use as your spending limit.

- Self Credit Builder Account (Starts at $25/month for 24 months): This is a credit builder loan that helps you save money while building credit.

- Kikoff Credit Account (Starts at $5/month): A micro-loan that reports to credit bureaus, helping you build payment history with small, manageable payments.

The Bottom Line Your Credit Score is a Marathon, Not a Sprint

Missing a payment can feel like a huge setback, and it definitely has consequences. But it's not the end of the world. By understanding how late payments affect your credit score, taking proactive steps to avoid them, and knowing how to recover if one does happen, you can maintain good financial health. Remember, building and maintaining a strong credit score is a marathon, not a sprint. Consistency, diligence, and smart financial habits will get you to the finish line with a healthy credit profile.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)