6 Common Budgeting Mistakes and How to Avoid Them

Identify six common budgeting errors and learn practical ways to avoid them to maintain a healthy financial plan.

6 Common Budgeting Mistakes and How to Avoid Them

Hey there, money-savvy friends! Let's be real, budgeting isn't always the most exciting topic, but it's absolutely crucial for your financial well-being. Whether you're just starting your financial journey or you've been at it for a while, it's easy to fall into some common traps. But don't sweat it! We're here to walk you through six of the most frequent budgeting blunders and, more importantly, how to steer clear of them. Think of this as your friendly guide to keeping your finances on track, no matter where you are in the world, be it the bustling streets of New York or the vibrant markets of Jakarta.

Mistake 1 Ignoring Your Spending Habits Budgeting Basics

This is probably the granddaddy of all budgeting mistakes. Many people create a budget based on what they think they spend, not what they actually spend. It's like trying to bake a cake without knowing how much flour you really have. You might end up with a delicious disaster!

Why it happens: Lack of Tracking and Awareness

We live in a world of instant gratification and easy payments. Tap your card, click 'buy now,' and poof, money gone! It's easy to lose sight of where every dollar goes. Without actively tracking your expenses, you're essentially flying blind. This is especially true for those small, seemingly insignificant purchases – that daily coffee, the spontaneous online order, or the extra streaming service. They add up, and often, they add up to a lot more than you'd ever imagine.

How to avoid it: Track Every Penny for a Month

The best way to combat this is to become a detective of your own spending. For at least one month, track every single dollar you spend. Yes, every single one. This might sound tedious, but it's incredibly enlightening. You can do this manually with a notebook, use a spreadsheet, or leverage one of the many fantastic budgeting apps out there. The goal is to get a crystal-clear picture of your actual spending habits. Once you see where your money is truly going, you can make informed decisions about where to cut back or reallocate funds.

Recommended Tools for Tracking Spending:

- Mint (US & Canada Focus): This free app links to your bank accounts, credit cards, and investments, automatically categorizing your transactions. It's fantastic for getting an overview of your finances and setting budget goals. It also offers bill reminders and credit score tracking. While primarily US-centric, its robust features make it a go-to for many.

- You Need A Budget (YNAB) (Global, Subscription): YNAB is a powerful, rule-based budgeting app that focuses on giving every dollar a job. It's a bit more hands-on but incredibly effective for those who want to be very intentional with their money. It has a strong community and excellent educational resources. YNAB offers a 34-day free trial, then typically costs around $14.99/month or $99/year.

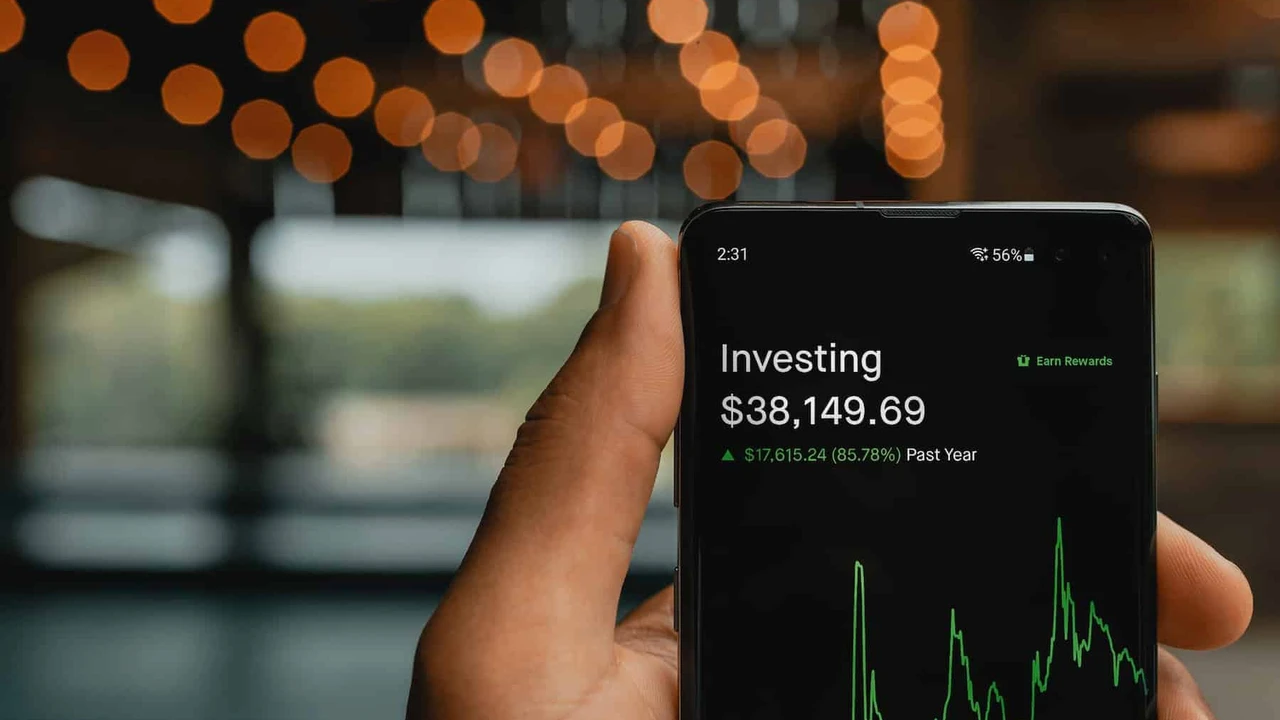

- Personal Capital (US Focus, Free for Tracking): While known for investment tracking, Personal Capital also offers excellent free budgeting tools. It provides a holistic view of your financial life, including net worth, cash flow, and spending. It's particularly useful if you have investments you want to monitor alongside your budget.

- Spendee (Global, Freemium): Spendee is a visually appealing app that allows you to track expenses, income, and budgets. It supports multiple currencies and can connect to bank accounts in various countries, making it a good option for users in Southeast Asia. The free version offers basic tracking, while premium features (bank sync, unlimited budgets) cost around $2.99/month or $22.99/year.

- Manual Spreadsheet (Global, Free): Don't underestimate the power of a good old Google Sheet or Excel spreadsheet. You can customize it exactly to your needs, and it forces you to manually input everything, which can be a powerful way to internalize your spending.

Mistake 2 Setting Unrealistic Budget Goals Financial Planning Pitfalls

We've all been there. You get super motivated, decide you're going to cut out all discretionary spending, and live on ramen noodles for a month. While admirable in theory, this often leads to burnout and giving up on your budget altogether. It's like going from zero to running a marathon overnight – you're likely to injure yourself.

Why it happens: Over-enthusiasm and Underestimation

The desire to save money quickly can lead to overly aggressive budgeting. We underestimate our needs and wants, especially when it comes to things that bring us joy or convenience. Cutting out everything you enjoy is a recipe for failure. A budget should be a tool that empowers you, not a straitjacket that suffocates you.

How to avoid it: Start Small and Be Flexible

Instead of a drastic overhaul, aim for small, sustainable changes. If you spend $300 on dining out, try to cut it to $250 next month, not $50. Build in some 'fun money' or 'miscellaneous' categories. Life happens, and your budget needs to be able to bend without breaking. Review your budget regularly (weekly or monthly) and adjust it as needed. If you consistently overspend in one category, either find ways to reduce that spending or adjust your budget to reflect reality. The goal is progress, not perfection.

Mistake 3 Not Budgeting for Irregular Expenses Unexpected Costs Management

Your car registration, annual insurance premiums, holiday gifts, or even that biannual dental check-up – these aren't monthly expenses, but they definitely hit your wallet. If you don't plan for them, they can derail your budget and leave you feeling financially stressed.

Why it happens: Out of Sight Out of Mind

Because these expenses don't occur every month, they often slip our minds when we're setting up our regular budget. We focus on the recurring bills and forget about the less frequent but equally important ones. Then, when they pop up, it feels like an unexpected financial punch.

How to avoid it: Create a Sinking Fund

A sinking fund is essentially a savings account specifically for these irregular expenses. List all your known irregular expenses for the year, estimate their cost, and divide by 12. Then, set aside that amount each month. For example, if your car insurance is $1200 annually, put $100 into a sinking fund each month. When the bill comes, the money is already there, waiting for you. This strategy works wonders for holiday shopping, car maintenance, home repairs, and even vacations. Many banks allow you to create sub-accounts or 'buckets' within your main savings account, making this super easy to manage.

Example Sinking Fund Categories:

- Car Maintenance: Oil changes, tire rotations, unexpected repairs.

- Medical/Dental: Co-pays, deductibles, annual check-ups.

- Gifts: Birthdays, holidays, anniversaries.

- Travel: Future vacations, weekend getaways.

- Home Repairs: Appliance breakdowns, roof maintenance.

- Annual Subscriptions: Software, memberships, streaming services.

Mistake 4 Forgetting to Budget for Fun and Self Care Lifestyle Budgeting

A budget that's all work and no play is a budget that's destined to fail. If you cut out all your discretionary spending – dining out, entertainment, hobbies, self-care – you're setting yourself up for resentment and eventual abandonment of your financial plan. Remember, a budget is about control, not deprivation.

Why it happens: The Austerity Trap

When people decide to get serious about their finances, they often swing to the extreme, believing that every penny must go towards debt repayment or savings. While these are noble goals, completely neglecting your personal well-being and enjoyment is unsustainable. We need outlets, relaxation, and things that bring us joy to stay motivated.

How to avoid it: Allocate Fun Money

Consciously allocate a specific amount of money each month for 'fun' or 'personal spending.' This could be for dining out, going to the movies, a new book, a massage, or whatever brings you joy. The key is to budget for it, so you can enjoy these things guilt-free, knowing they fit within your financial plan. This 'fun money' category is just as important as your rent or utility bill because it helps you stick to your budget long-term. It's about balance.

Mistake 5 Not Reviewing and Adjusting Your Budget Regularly Budget Review Process

Your life isn't static, so why should your budget be? A budget isn't a 'set it and forget it' tool. It's a living document that needs regular attention and adjustments to remain effective. Life changes – you get a raise, a new expense pops up, your priorities shift – and your budget needs to reflect those changes.

Why it happens: Complacency and Time Constraints

Once a budget is set up, it's easy to become complacent and assume it's working perfectly. Or, life gets busy, and reviewing your finances falls to the bottom of the to-do list. However, neglecting this crucial step can lead to your budget becoming irrelevant and ineffective over time.

How to avoid it: Schedule Monthly Check-ins

Set aside 30-60 minutes once a month to review your budget. Compare your actual spending to your budgeted amounts. See where you overspent and where you underspent. Ask yourself: 'Is this budget still working for me? Are my financial goals still aligned with my spending?' Make adjustments as needed. Maybe you need to increase your grocery budget because prices went up, or perhaps you can reallocate some funds from an underspent category to boost your savings. This regular check-in keeps your budget relevant and ensures you're always in control of your money.

Mistake 6 Not Having an Emergency Fund Financial Safety Net

This isn't strictly a budgeting mistake, but it's a massive financial blunder that can completely derail even the most meticulously planned budget. Life throws curveballs – unexpected job loss, medical emergencies, car breakdowns, home repairs. Without an emergency fund, these events can force you into debt, undoing all your hard work.

Why it happens: Prioritizing Other Goals or Underestimating Risk

Many people prioritize debt repayment or investing over building an emergency fund. While those are important, an emergency fund provides a crucial buffer. Others simply underestimate the likelihood of an unexpected expense or believe they can handle it when it comes. Unfortunately, that's often not the case.

How to avoid it: Prioritize Building 3-6 Months of Expenses

Make building an emergency fund a top financial priority. Aim to save at least three to six months' worth of essential living expenses (rent/mortgage, utilities, food, transportation, insurance). Keep this money in a separate, easily accessible, high-yield savings account. This way, it's there when you need it, but not so easy to dip into for non-emergencies. Think of it as your financial airbag – you hope you never need it, but you'll be incredibly grateful if you do. Once you have a fully funded emergency fund, you'll feel a profound sense of financial security and peace of mind.

Recommended High-Yield Savings Accounts (US Focus):

- Ally Bank Online Savings Account: Known for competitive interest rates, no monthly fees, and 24/7 customer service. It's a popular choice for emergency funds due to its accessibility and reliability.

- Discover Bank Online Savings Account: Offers strong interest rates, no monthly fees, and easy online access. It also has a highly-rated mobile app.

- Marcus by Goldman Sachs Online Savings Account: Another top contender with competitive rates, no fees, and a user-friendly online platform.

- Capital One 360 Performance Savings: Good rates, no fees, and seamless integration if you already bank with Capital One.

Budgeting doesn't have to be a chore. By avoiding these common mistakes and implementing these practical strategies, you can take control of your finances, reduce stress, and work towards achieving your financial goals. Remember, it's a journey, not a destination, and every step you take towards better financial habits is a win. Happy budgeting!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)