5 Best Ways to Improve Your Credit Score in the US

Discover five effective strategies to boost your credit score in the US, helping you secure better loan rates and financial opportunities.

Discover five effective strategies to boost your credit score in the US, helping you secure better loan rates and financial opportunities.

5 Best Ways to Improve Your Credit Score in the US

Hey there! Ever feel like your credit score is a mysterious beast that dictates your financial life? You're not alone. In the United States, your credit score is a huge deal. It's not just a number; it's a three-digit summary of your financial trustworthiness. Lenders, landlords, and even some employers use it to gauge your reliability. A good credit score can unlock lower interest rates on loans, better terms on credit cards, and even make it easier to rent an apartment or get a cell phone plan. On the flip side, a low score can make life a lot harder and more expensive. But here's the good news: your credit score isn't set in stone. With a bit of effort and some smart strategies, you can absolutely improve it. This comprehensive guide will walk you through the five best ways to boost your credit score, offering practical advice, real-world scenarios, and even some product recommendations to help you on your journey. We're talking about actionable steps you can take right now to start seeing those numbers climb. So, let's dive in and demystify the world of credit scores!

Understanding Your Credit Score What It Is and Why It Matters

Before we jump into improvement strategies, let's quickly cover the basics. What exactly is a credit score, and why is it so important? In the US, the most common credit scoring model is FICO, with scores ranging from 300 to 850. Another popular model is VantageScore, which also ranges from 300 to 850. While the exact algorithms are proprietary, both models consider similar factors. These factors include your payment history (the biggest chunk!), amounts owed (how much debt you have), length of credit history (how long you've had credit), new credit (recent applications), and credit mix (types of credit accounts). Each of these plays a role in determining your score. Why does it matter? Well, a higher score signals to lenders that you're a responsible borrower, making them more likely to lend you money at favorable rates. This translates to saving thousands of dollars over the life of a mortgage or car loan. It can also impact your ability to get approved for certain jobs, rent an apartment, or even get better rates on insurance. So, understanding these basics is the first step toward taking control of your financial future.

Strategy 1 Pay Your Bills On Time Every Time for Credit Score Boost

This might sound like a no-brainer, but seriously, paying your bills on time is the single most impactful thing you can do for your credit score. Your payment history accounts for about 35% of your FICO score, making it the largest factor. Even one late payment (especially if it's 30 days or more past due) can significantly ding your score and stay on your report for up to seven years. Consistency is key here. Every on-time payment builds a positive history, showing lenders you're reliable. Think of it like building a good reputation; every positive interaction adds to it.

Practical Tips for Timely Payments

- Set up automatic payments: This is probably the easiest way to ensure you never miss a due date. Most banks and credit card companies offer this feature. Just make sure you have enough funds in your account to cover the payments.

- Use calendar reminders: If you prefer to manually pay, set up reminders on your phone or computer a few days before each bill is due.

- Consolidate due dates: Some creditors might allow you to change your due date to align with your pay schedule or other bills, making it easier to manage.

- Pay more than the minimum: While paying the minimum keeps you current, paying more helps reduce your overall debt faster, which indirectly helps your credit utilization (more on that next!).

Scenario: Sarah's Payment Journey

Sarah used to be a bit disorganized with her bills. She'd often pay a few days late, sometimes even missing a payment entirely. Her credit score hovered in the low 600s. After realizing the impact, she set up automatic payments for all her credit cards, student loans, and utility bills. Within six months, her score started to climb, and after a year of consistent on-time payments, it jumped by over 50 points. This opened doors for her to refinance her car loan at a much lower interest rate, saving her a significant amount each month.

Strategy 2 Keep Your Credit Utilization Low Manage Your Debt Wisely

Your credit utilization ratio is another huge factor, accounting for about 30% of your FICO score. This ratio is calculated by dividing the total amount of credit you're using by your total available credit. For example, if you have a credit card with a $10,000 limit and you've charged $3,000, your utilization is 30%. The general rule of thumb is to keep this ratio below 30% across all your credit accounts. Lower is always better, with the ideal being under 10%.

How to Lower Your Credit Utilization

- Pay down balances: The most direct way is to pay off your credit card balances as much as possible. Focus on cards with high balances first.

- Make multiple payments a month: Instead of waiting for the statement due date, make smaller payments throughout the month. This can keep your reported balance lower.

- Request a credit limit increase: If you're a responsible borrower, you can ask your credit card company for a credit limit increase. This increases your total available credit, which can lower your utilization ratio, assuming your spending doesn't increase proportionally. Be cautious with this, as a hard inquiry might temporarily ding your score.

- Avoid closing old credit accounts: While it might seem counterintuitive, closing an old credit card can actually hurt your utilization. It reduces your total available credit, potentially increasing your ratio.

Product Recommendation: Balance Transfer Credit Cards

If you have high-interest credit card debt, a balance transfer credit card can be a game-changer. These cards often offer a 0% APR introductory period (typically 12-21 months) on transferred balances. This allows you to pay down your principal without accruing interest, making it easier to reduce your utilization. Here are a few popular options:

- Chase Slate Edge: Offers a 0% intro APR for 18 months on balance transfers and purchases. No annual fee. Balance transfer fee applies (usually 3-5%).

- Citi Simplicity Card: Known for one of the longest 0% intro APR periods, often up to 21 months on balance transfers. No late fees or penalty rates. Balance transfer fee applies.

- BankAmericard Credit Card: Provides a 0% intro APR for 18 months on balance transfers and purchases. No annual fee. Balance transfer fee applies.

Usage Scenario: John had $7,000 spread across two credit cards with high interest rates. His credit utilization was over 60%. He applied for a Citi Simplicity Card, transferred his balances, and committed to paying $400 a month. With no interest accruing for 21 months, he was able to pay off a significant portion of his debt, bringing his utilization down to under 20% and seeing a substantial jump in his credit score.

Strategy 3 Build a Long Credit History Don't Close Old Accounts

The length of your credit history accounts for about 15% of your FICO score. Lenders like to see a long history of responsible credit use. This factor considers the age of your oldest account, the age of your newest account, and the average age of all your accounts. The longer your credit history, the better, as it provides more data points for lenders to assess your reliability.

Why Old Accounts Are Gold

- Demonstrates consistency: A long history shows a consistent pattern of managing credit over time.

- Increases average age: Keeping old accounts open increases the average age of your accounts, which is a positive signal.

- Maintains available credit: As mentioned before, closing an old account reduces your total available credit, which can negatively impact your utilization ratio.

What to Do with Old Accounts

- Keep them open and active: Even if you don't use an old credit card regularly, make a small purchase once every few months and pay it off immediately. This keeps the account active and prevents the issuer from closing it due to inactivity.

- Avoid opening too many new accounts at once: While new credit can be good, opening too many accounts in a short period can lower the average age of your accounts and trigger multiple hard inquiries, which can temporarily ding your score.

Scenario: Maria's Credit Longevity

Maria had a credit card from her college days that she rarely used. She considered closing it to simplify her finances. However, after learning about the importance of credit history length, she decided to keep it open. She now uses it for a small recurring subscription and pays it off monthly. This old account, now over 15 years old, significantly contributes to the overall length of her credit history, helping to maintain her excellent credit score.

Strategy 4 Diversify Your Credit Mix Types of Credit Accounts

Your credit mix accounts for about 10% of your FICO score. This factor looks at the different types of credit accounts you have, such as revolving credit (credit cards) and installment loans (mortgages, car loans, student loans). Having a healthy mix of both shows that you can responsibly manage various types of debt. It's not about having a ton of different accounts, but rather demonstrating your ability to handle different financial commitments.

Building a Healthy Credit Mix

- Don't open accounts just for the sake of it: Only take on new credit if you genuinely need it and can afford the payments. Unnecessary debt will do more harm than good.

- Consider a secured loan: If you're struggling to get approved for traditional loans, a secured loan (like a secured credit card or a credit-builder loan) can help you establish a credit mix.

Product Recommendation: Secured Credit Cards and Credit-Builder Loans

These products are excellent for individuals with limited credit history or those looking to rebuild their credit. They help you establish a positive payment history and diversify your credit mix.

Secured Credit Cards

With a secured credit card, you put down a cash deposit, which typically becomes your credit limit. This deposit acts as collateral, reducing the risk for the issuer. As you use the card responsibly and make on-time payments, the issuer reports your activity to the credit bureaus. After a period of good behavior, you might be eligible to upgrade to an unsecured card and get your deposit back.

- Discover it Secured Credit Card: No annual fee, reports to all three major credit bureaus, and offers cash back rewards. Requires a security deposit (minimum $200).

- Capital One Platinum Secured Credit Card: No annual fee, reports to all three major credit bureaus, and offers a path to an unsecured card. Security deposit required (can be as low as $49 for some).

Usage Scenario: David had no credit history and was struggling to get approved for a regular credit card. He opened a Discover it Secured Credit Card with a $500 deposit. He used it for small purchases and paid the balance in full every month. After 10 months, his credit score improved significantly, and Discover upgraded him to an unsecured card, returning his deposit.

Credit-Builder Loans

A credit-builder loan works a bit differently. You borrow a small amount of money, but instead of receiving it upfront, the funds are held in a locked savings account or CD. You make monthly payments on the loan, and these payments are reported to the credit bureaus. Once the loan is fully paid off, you receive the money. It's essentially a forced savings plan that builds your credit.

- Self Credit Builder Account: Offers loans ranging from $525 to $3,100, with terms from 12 to 24 months. Reports to all three major credit bureaus. Fees apply.

- Local Credit Unions: Many local credit unions offer their own credit-builder loan programs, often with competitive rates and personalized service.

Usage Scenario: Emily had a few negative marks on her credit report and a limited credit mix. She took out a Self Credit Builder Account for $1,000 over 12 months. Her monthly payments were reported, and by the end of the year, she had $1,000 in savings and a much-improved credit score, demonstrating her ability to handle an installment loan.

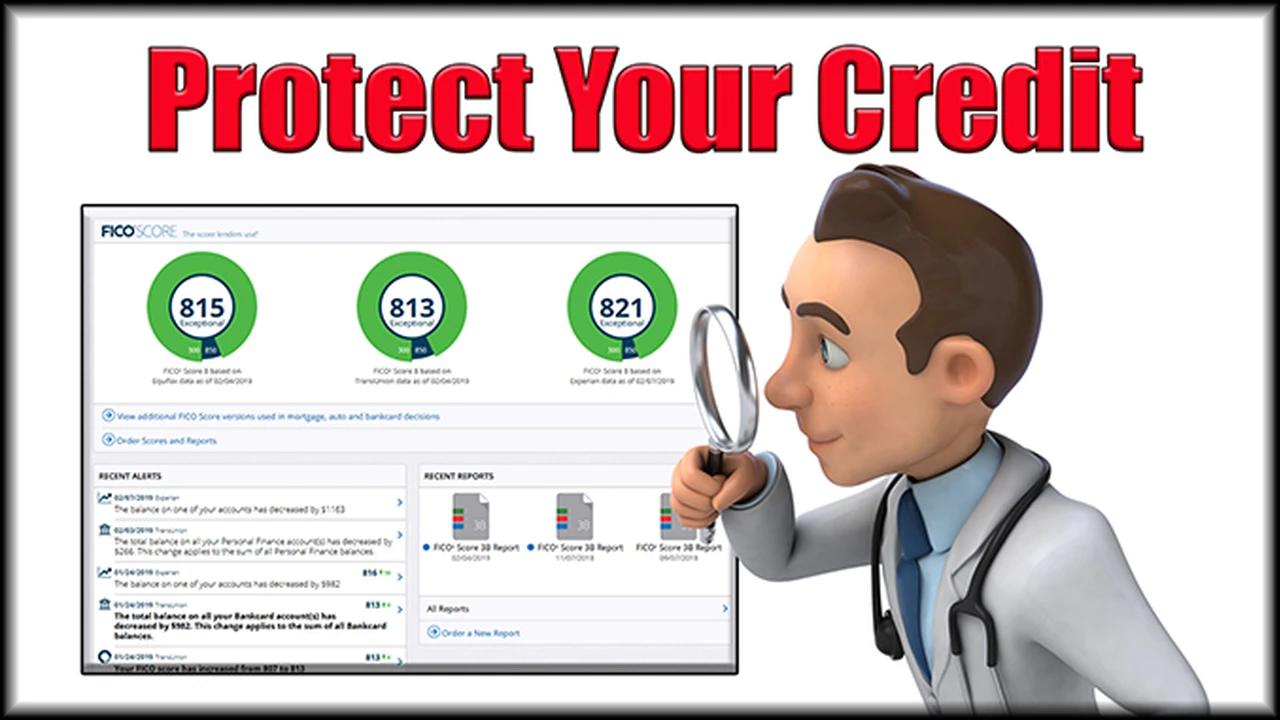

Strategy 5 Monitor Your Credit Report Regularly Check for Errors and Fraud

This strategy is less about actively building credit and more about protecting what you've built. Your credit report is a detailed record of your credit history, and errors can occur. These errors, even small ones, can negatively impact your score. Furthermore, monitoring your report helps you detect potential identity theft or fraudulent activity early on.

How to Monitor Your Credit Report

- Annual Free Reports: By law, you're entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. You can access these at www.annualcreditreport.com. It's a good idea to pull one report every four months (e.g., Experian in January, Equifax in May, TransUnion in September) to keep a continuous eye on your credit.

- Credit Monitoring Services: Many credit card companies and banks offer free credit monitoring services that alert you to changes in your report. There are also paid services that offer more in-depth monitoring and identity theft protection.

Product Recommendation: Free and Paid Credit Monitoring Services

Free Services

- Credit Karma: Provides free credit scores (VantageScore) and reports from TransUnion and Equifax. Offers insights and recommendations.

- Credit Sesame: Offers free credit scores (VantageScore) and monitoring, along with personalized financial advice.

- Experian Free Credit Report and FICO Score: Experian offers a free account that provides your Experian FICO score and report, updated monthly.

Paid Services (for more comprehensive protection)

- IdentityForce: Offers robust identity theft protection, credit monitoring from all three bureaus, and identity restoration services. Plans typically start around $17-$20 per month.

- LifeLock: A well-known identity theft protection service that includes credit monitoring, dark web monitoring, and identity restoration. Plans vary widely, from $10 to $30+ per month.

- MyFICO: Directly from the creators of the FICO score, this service provides access to all three bureau FICO scores and reports, along with monitoring and alerts. Plans start around $29.95 per month.

Usage Scenario: Robert regularly checked his free credit reports. One year, he noticed an unfamiliar credit card account opened in his name. Thanks to his vigilance, he was able to quickly dispute the fraudulent account with the credit bureau and the card issuer, preventing significant damage to his credit score and financial identity. Without monitoring, this could have gone unnoticed for months or even years.

Bonus Tips for Credit Score Optimization

Beyond the five core strategies, here are a few extra tips to keep in mind as you work on improving your credit score:

- Become an authorized user: If a trusted family member with excellent credit adds you as an authorized user on one of their credit cards, their positive payment history can reflect on your credit report. Just make sure they are truly responsible, as their mistakes could also impact you.

- Dispute inaccuracies: If you find any errors on your credit report, dispute them immediately with the credit bureau. They are legally obligated to investigate and correct any verified inaccuracies.

- Be patient: Improving your credit score is a marathon, not a sprint. It takes time and consistent effort to see significant results. Don't get discouraged if you don't see a huge jump overnight.

- Avoid unnecessary credit applications: Each time you apply for new credit, a hard inquiry is placed on your report, which can temporarily lower your score by a few points. Only apply for credit when you genuinely need it.

- Consider a secured loan or credit-builder loan: As mentioned earlier, these are great tools for those with limited or poor credit to establish a positive payment history and diversify their credit mix.

Improving your credit score is a journey that requires discipline and consistency, but the rewards are well worth the effort. By diligently applying these strategies – paying bills on time, keeping utilization low, maintaining a long credit history, diversifying your credit mix, and regularly monitoring your reports – you'll be well on your way to a healthier financial future. A strong credit score opens doors to better financial opportunities, saving you money and reducing stress. So, take these steps, stay persistent, and watch your financial power grow!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)